A consumer must register their card account by providing the sixteen-digit card account number along with other related personal information. This service is free for all members and there are no hidden fees for registering your card. To sign up for your Verve credit card account, simply follow the steps below.

or

I am presenting you with a credit card issued by the Bank of Missouri for the purpose of payment. The Verve credit card may be right for you if you’re wondering if you should apply for one. We have provided all the information you need to make a good decision based on the information in this review.

How To Register An Account On The Verve Card Website?

To get the most out of the Site, it is important that you know how to create an account on the Site at www.vervecardinfo.com login. Below are the steps to follow if you want to create an account.

- Open the website on your device via your web browser or click https://www.vervecardinfo.com/about.html.

- From the options listed, click the Connect button.

- Click the Register Now button below the registration form.

- Fill in the form provided with the “last 4 digits of your credit card”, “last 4 digits of your SSN” and “5 digits of your zip code”.

- Click Find Account.

- Use the on-screen instructions to complete the process on the website. Next, we’ll show you how to log into your account on the site.

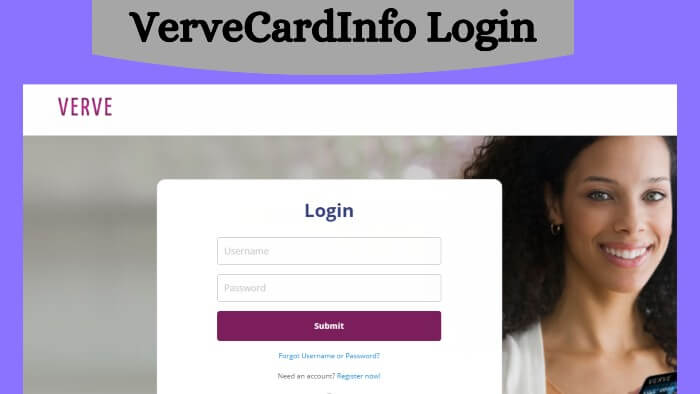

Follow The Login Process

- There is also the possibility of directly accessing the VerveCardInfo Login page from the URL, which can also be used if you wish. Please see our websites: www.vervecardinfo.com and www.vervecardinfo.ca for more information.

- A button called “VerveCardInfo Login” can be found on the right-hand side of the home page at the top of this site. You can start exploring our website by clicking on the link below.

- By clicking on the link, you will be taken to a new website called “Verve Card Online Account Access”. Here, you will be able to access your online account information along with other information related to your card.

- The registration section of the website is located in the middle of the page.

- It is necessary to enter the username and password into the two fields in the box, and then select the submit button after you have entered the two fields.

VerveCardInfo Login Conditions

To log into the account, the user must have a few things on hand. Here are the registration requirements:

Internet: To log in to VerveCardInfo, you need an Internet connection.

Electronic Device: The user can use any electronic device, such as a computer, laptop, or smartphone.

Active Account: You must register for online account management to log in online. If you haven’t created an account yet, you can register for free.

Personal Device: Logging into your account is recommended using a personal device. This allows you to protect your financial information and even save your passwords.

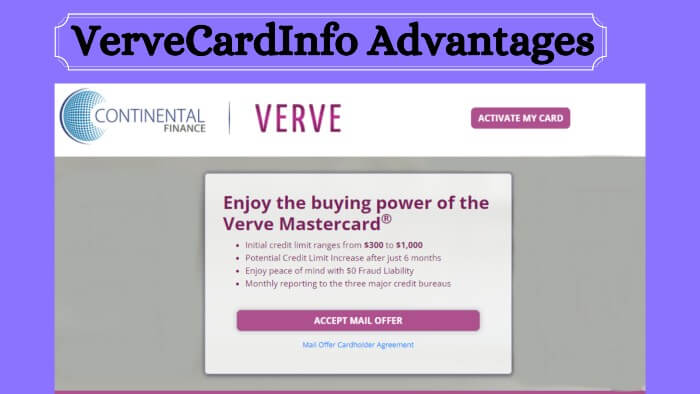

What Are The Verve MasterCard Benefits?

With Verve MasterCard, you get many benefits. These are some of the advantages of credit cards.

- Even those with a credit limit of $700 on their credit card are able to apply for the credit card.

- In order to improve your credit score and to improve your credit rating, you should be sending monthly reports to all three credit bureaus.

- It is possible to get a credit card that offers a fraud liability of zero dollars.

- It is possible to request an increase in your credit limit after 6 months.

Check Out The Portal Features

The same card has a low initial credit limit and is specially designed for those with average or bad credit. The idea is that if you make your payments on time and stay within your credit limit, this card can help rebuild and improve your credit score.

- After six months, you can increase your credit limit

- As a cardholder, if you have no overdue debts and your credit limit has not been reached after six months, you can request an increase to your credit limit.

- A credit of up to $1,000 is available

- VerveCardInfo credit scores are available for free on your VerveCardInfo account, and they are updated every month by a VerveCardInfo credit expert. The benefit of this is that you are able to track your credit score as it rises and gains momentum while still managing your credit obligations at the same time.

- Purchases made with fraudulent intent are not covered by this policy

- The Verve credit card does not have liability for unauthorized purchases made by others if you lose your card or if the number of your card is stolen.

Fees Structure Of Verve Card

- Verve Credit Card Initial Fee: $0.

- Verve Mastercard Annual Fee: $59.95 (not applicable to eStatements).

- Late fees can be up to 27% of the balance or a minimum charge of $27, whichever is greater. If your account is late, Continental Verve may charge an additional late fee and notify you by email before it is added to your account. The maximum late fee you may be charged is $38 for each month a statement is received at least 30 days after the due date.

- Overlimit Fee: Up to 29.4% on the amount above your credit limit, plus accrued interest.

- International transaction fees: up to 3%.

- Return costs: Varies (usually 12% of face value).

| Official Name | VerveCardInfo |

|---|---|

| Portal Type | Login Portal |

| Managed By | Continental Finance |

| Language | English |

| Country | USA |

Know The Various Verve Login Services

Online Account Management

With Verve Credit Card Web Access, you can manage your Verve credit card account anytime, anywhere. You can view detailed information about your Verve purchases and payments, as well as all transactions reported in your Verve report for major credit bureaus.

Free Perk Score

When you sign up for eStatements with Continental Verve, you also receive a free Vantage Score, a third-party service used by lenders to assess credit quality. Your score is updated every 30 days, making it easy to track changes over time.

Customer Service

Verve Credit Card customer service is available 24/7 at 1-866-449-4514 to answer your questions.

Credit Protection

The Verve Credit Card offers credit protection by adding an extra layer of security to your Verve in the Continental Verve Loyalty Rewards program.

VerveCardInfo App

Verve Credit Card mobile, VerveCardInfo App can be downloaded for free from Google Play Store or VerveCardInfo App Store to easily manage your account.

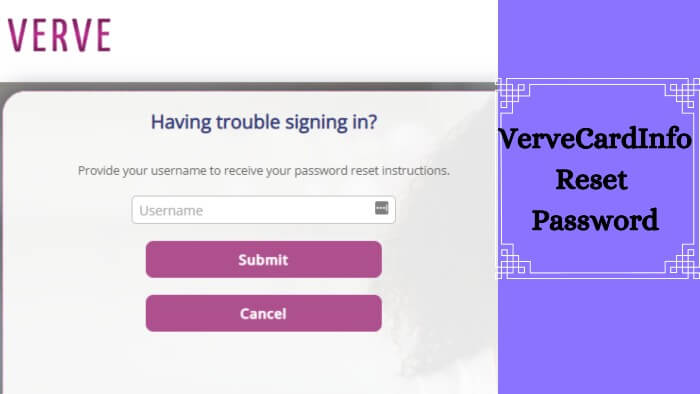

Retrieve Forgotten Credentials

- If a user cannot remember the username or password, they must go to the VerveCardInfo Login page.

- When the site opens, look for the VerveCardInfo Login widget.

- In order to reset your username or password, please click on “Have you forgotten your username or password?”. directly below the connection area.

- Then you will find the “Having trouble logging in?” section.

- Choose if you forgot your username or password.

- Also Read: Comdata Card Account Registration Process

Those who have lost their username should open the following.

- Last 4 credit card

- SSN Last 4th

- zip code or date of birth

- Did you forget your password

- To reset the password, enter the username.

- Now you can get the steps to reset your password.

About

The Verve card is offered by Continental Finance, a company that specializes in credit cards for consumers with less than perfect credit. His website has an impressive customer base of over 3 million. VerveCardInfo offers a card for business people and consumers.

If you plan to withdraw your balance in full each month, this card might be for you. Verve offers an introductory 0% APR on purchases and balance transfers for 18 billing cycles. This is one of the longest 0% induction periods in the industry. Thereafter, the effective annual interest rate is 15.24% to 29%.

Verve Card Info Login is a website created by the Continental Financial Institution. This was done to educate users on the importance and use of Verve Card Info Login.

The online account VerveCardInfo Login portal was created in collaboration with Verve Card Info Login and Continental Finance. Once you have the credit card in your wallet, you can log into your account. The user can also create an account at any time if he has not already done so.

Common Questions

Can I apply with a co-applicant or a joint account?

No, you can not. However, you can add an authorized user.

How long does it take for Verve Mastercard to approve my application?

In most cases, the decision is immediate. In cases where they need more information, it can take up to 30 days.

When will I receive my new Verve credit card?

Your Reflex credit card will be mailed to you within 3 business days of approval.

My Verve credit card has not been VerveCardInfo Activate Card yet, how can I do that?

You can VerveCardInfo Activate Card online.

Customer Service

Verve contact details

Lost or stolen card: 1-800-556-5678.

Automated VerveCardInfo Customer Service and account information: 1-866-449-4514

(Available Monday through Friday 7:00am to 11:00pm, Saturday 9:00am to 4:00pm EST).

Payments: 1-800-518-6142

(Available Monday through Friday 7:00am to 11:00pm, Saturday 9:00am to 4:00pm EST).

Mail – Information: Verve Card, P.O. PO Box 3220, Buffalo, New York 14240-3220.

Mail – Payments: Verve Card, P.O. PO Box 6812, Carol Stream, IL 60197-6812.

Online Account Access: www.vervecardinfo.com.

Bottom Line

The Continental Verve credit card is one of the best options for anyone looking for a credit card, even if they have bad or average credit. The interest rate on this product can be expensive, but paying your bills on time can improve your credit score and qualify you for better interest rates in the future.

Consumers who can benefit from this product include those trying to build a good payment history or those with less than stellar credit who are just starting out and need financial help to regain a good reputation.

It also helps that Continental VerveCardInfo maintains a fraud liability policy if your card is lost or stolen, which happens more often than it should.