If you are looking for a way to boost your credit score, you can use the Verve Credit Card. As a result, this is not always the best option when it comes to the creation of credit cards and we will discuss the reasons why in the following paragraphs.

What Are The Verve Card Advantages?

Verve Mastercard Credit Creation Resources

It’s important to remember that the Continental VervecreditInfo card is a great credit card that can help you increase your balance and give you access to your rewards program as well as manage your account.

Anyone looking to build credit after a financial crisis, maintain a good credit history or restore their reputation will find it easy with the Continental Verve credit card.

Verve Mastercard’s free monthly credit score monitoring has proven to be one of the easiest ways to track changes to your TransUnion credit report, which can help improve your chances of future report approval.

Continental Verve allows consumers to start building a positive payment history. With this card, the member can take advantage of the available credit line and make small purchases without the need for large sums of money or upfront guarantees.

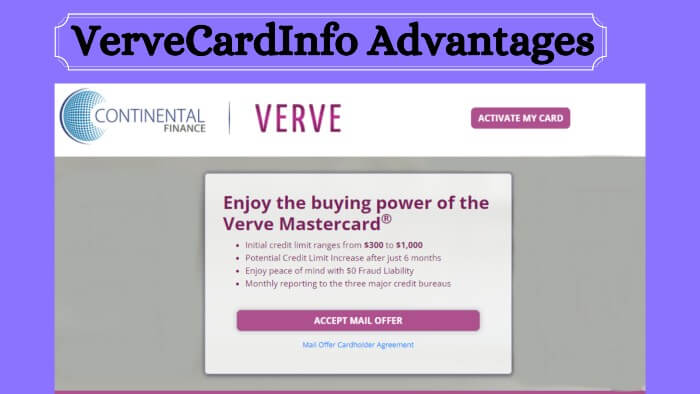

Verve Mastercard Credit Limit

The Verve card is for people with limited credit who are trying to improve their credit score. A MasterCard can be used anywhere MasterCards are accepted, and it has a spending limit available based on your personal credit history.

Based on the applicant’s income level and ability to pay, as well as other factors, Verve’s credit limit ranges from $300 to $3,500, although most people tend to get approved between $300 and $1,000 depending on the applicant’s income level.

$0 Fraud Liability

Continental Verve will not be responsible for unauthorized charges to your card. If your card is lost or stolen, they replace it immediately and protect you from fraudulent activity.